.png)

Franchising in India is a rapidly growing business model, contributing 2% to the country's GDP, with over 200,000 outlets and employing up to 6 million people. The industry is valued at USD 48 billion and is expected to reach USD 150 billion by 2028, with strong growth in Tier 2 and Tier 3 cities.

However, India has no dedicated franchise law. Instead, franchising operates under general laws, such as the Indian Contract Act, the Specific Relief Act, the Consumer Protection Act, and FDI regulations. This creates a complex legal landscape for both franchisors and franchisees.

This article outlines the major franchise legalities in India, including franchise agreements, intellectual property protection, and compliance, to help you in managing risks while starting a successful franchise firm.

Franchising is a business model where a franchisor (the owner of a business or brand) allows a franchisee (an individual or company) to operate a business under the franchisor's brand and system in exchange for a fee or royalties.

The franchise model has seen tremendous growth in India due to its low-risk nature and high potential for success. Entrepreneurs and investors prefer franchising because it enables them to use an established brand with a proven business model.

With India’s growing consumer market and increasing purchasing power, franchising is seen as a low-barrier entry into business ownership, especially for first-time entrepreneurs.

Ready to enter the food franchise industry with minimal overhead? Kouzina’s multi-brand cloud kitchen model allows you to operate several food brands from a single location.

Get started with just an initial investment of ₹12-15 lakhs. Let us help you build your cloud kitchen business from the ground up.

A crucial starting point for understanding franchising in India is recognizing the absence of a standalone franchise-specific legislation. This stands in contrast to countries like the United States or Canada, which have detailed franchise laws and disclosure requirements.

In India, the contractual relationship between a franchisor and a franchisee is primarily governed by general contract law principles.

This lack of specific legislation means that franchise arrangements are subject to various existing statutes, necessitating a thorough understanding of how these laws intersect and apply to the franchising industry.

While this framework offers a degree of flexibility, it also places a greater onus on both parties to meticulously draft their franchise agreements to cover all foreseeable aspects of their relationship.

The absence of a dedicated law emphasizes the critical role of a well-structured and legally sound franchise agreement in India.

Several existing Indian statutes collectively govern the franchising sector. These laws address various aspects of the franchise relationship, including contractual obligations and consumer protection.

This act forms the bedrock of all contractual relationships in India, including franchise agreements. It dictates essential elements for a valid contract. These include offer, acceptance, lawful consideration, and the capacity of parties to contract.

Any franchise agreement must comply with the provisions of this Act. It defines the rights and obligations of both the franchisor and the franchisee. This fundamental legislation also governs breaches of contract.

This Act provides remedies for the enforcement of individual civil rights. In a franchising context, it can be invoked to seek specific performance of contractual obligations or injunctions to prevent a party from breaching the agreement. This Act offers a mechanism for aggrieved parties to seek legal redress.

Intellectual property (IP) is the core asset of any franchise system. Protecting trademarks, copyrights, and proprietary know-how is paramount. Several Indian laws safeguard these vital assets.

Robust IP protection clauses must be meticulously incorporated into the franchise agreement. Regular monitoring and swift action against infringements are vital for brand integrity.

This Act aims to protect consumer rights against unfair trade practices. Both franchisors and franchisees can be held accountable for product quality and service standards.

Consumers can file complaints against deficiencies in goods or services. This act emphasizes the importance of consistent quality across all franchise outlets. Franchisors often implement stringent operational guidelines to ensure compliance with their standards.

This Act prevents anti-competitive practices and promotes fair competition. Franchise agreements must be carefully drafted to avoid violating this law. Clauses related to exclusive territorial rights or resale price maintenance can be scrutinized.

Restrictions on franchisees dealing with competitors must also be reasonable. The Competition Commission of India (CCI) oversees compliance.

FEMA is critical for international franchising in India. It regulates foreign investment and the repatriation of royalties and fees. Foreign franchisors must comply with FEMA guidelines for receiving payments from Indian franchisees.

The Reserve Bank of India (RBI) sets norms for such transactions. Recent policy liberalizations have eased restrictions on royalty payments.

This Act governs the taxation of franchise fees and royalties. Both franchisors and franchisees are required to comply with Indian tax laws. Income earned from franchise operations is subject to applicable income tax rates.

Cross-border franchise arrangements involve specific international tax implications. Expert tax advice is often necessary.

This Act provides a framework for alternative dispute resolution, primarily arbitration. Many franchise agreements include arbitration clauses. These clauses stipulate that disputes will be resolved through arbitration rather than court litigation.

Arbitration can be a faster and more cost-effective method. Indian courts generally uphold valid arbitration agreements.

The franchise agreement becomes the most crucial legal document in the franchise relationship. It defines the entire relationship between the franchisor and the franchisee. A comprehensive and well-drafted agreement is paramount for clarity and enforceability.

A robust franchise agreement in India typically includes several key provisions. Each section clearly outlines responsibilities and expectations.

Kouzina offers end-to-end cloud kitchen solutions, including kitchen setup, operational tools, and franchise support. Whether you’re a seasoned entrepreneur or a first-timer, we provide the support you need to succeed.

While India does not mandate a statutory disclosure document, including comprehensive disclosure requirements within the franchise agreement is a best practice.

This ensures transparency before the franchisee signs the contract. Disclosure should include information about the franchisor's background, financial performance, and existing franchisees.

It should also detail initial and ongoing costs. This helps franchisees make informed decisions. Misrepresentation by the franchisor can lead to civil or even criminal proceedings.

There is no specific franchise registration required in India. However, the franchisee's business entity must be properly registered. This typically involves registering as a private limited company or a limited liability partnership.

While not mandatory, trademark registration is crucial for protecting the brand and enforcing rights effectively. Depending on the industry, sector-specific licenses and permits are also necessary. For instance, food franchises require specific food safety licenses.

Must read: Legal Issues and Conflicts in Franchising You Must Know

Foreign companies seeking to enter the Indian market through franchising must be aware of the country's FDI policies. India's FDI policy dictates the permissible routes and limits for foreign investment.

FDI in India can occur via two routes:

FDI policies vary significantly by sector. For example, 100% FDI is allowed in the marketplace model of e-commerce under the automatic route. However, multi-brand retail has a 51% FDI cap, requiring government approval.

Single-brand retail allows 100% FDI, but only 49% is automatic. Understanding these sectoral caps is vital for foreign franchisors.

FEMA regulations govern the repatriation of royalties and franchise fees to foreign franchisors. Historically, there were limits on these payments.

However, the Indian government has largely liberalized these norms. Foreign franchisors can now charge lump-sum fees and royalties without specific maximum limits under the automatic route. All such payments, however, must comply with FEMA rules.

Foreign franchisors can establish their presence in India through various business structures. These include:

Each structure has its own set of compliance requirements under Indian law.

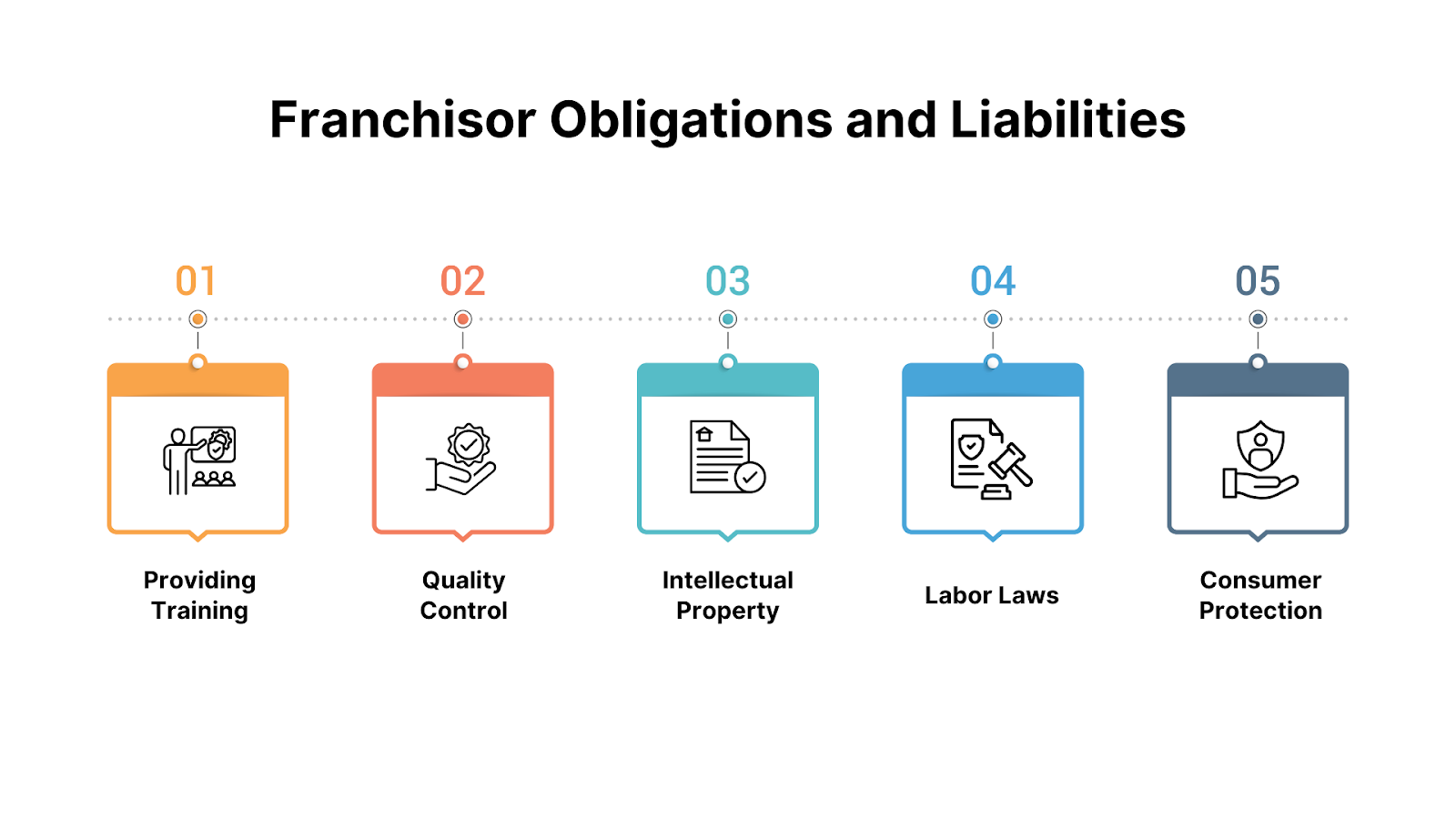

Franchisors have significant legal and operational obligations in India. These responsibilities extend beyond merely granting brand rights.

Franchisors must provide adequate initial training to franchisees. This ensures that the franchisee can operate the business in accordance with brand standards.

Ongoing support, including marketing, operational updates, and troubleshooting, is also expected. This support is crucial for maintaining consistency and brand image.

The franchisor is responsible for ensuring consistent product and service quality across all franchise units. This involves regular inspections, audits, and adherence to operational manuals and procedures.

Failure to maintain quality can harm the brand's reputation and lead to consumer complaints.

Franchisors must actively protect their intellectual property rights in India. This includes registering trademarks and taking action against infringement. They must also ensure proper usage of IP by franchisees, as per the agreement. Misuse of IP by franchisees can lead to legal complications for both parties.

While franchisees are typically independent entities, franchisors may have indirect liabilities related to labor practices.

Franchisors should provide guidelines to franchisees regarding fair wages, working conditions, and employment regulations. Non-compliance by franchisees can sometimes reflect negatively on the franchisor.

As mentioned, franchisors can be held accountable under the Consumer Protection Act for deficiencies.

If a franchisee engages in false advertising or provides substandard products, the franchisor might face legal repercussions. This highlights the need for robust oversight and clear operational protocols.

Also read: Guide to Starting and Running a Food Franchise Business in India

Franchising in India presents both opportunities and legal challenges. Proactive strategies can help mitigate these risks.

Franchising in India offers significant economic potential, but it is crucial to navigate the legal landscape carefully.

There is a lot to consider, from understanding franchise agreements to ensuring compliance with intellectual property rules, foreign direct investment requirements, and labor laws.

Both franchisors and franchisees can ensure a successful association and mitigate legal risks by staying up-to-date on franchise legalities in India.

Following these legal requirements will help you establish a strong foundation for long-term success, regardless of your goals for starting your franchise or expanding into India.

Kouzina is your trusted partner for launching and scaling a successful cloud kitchen business in India. With our comprehensive support—from kitchen setup to marketing strategies—your journey to becoming a food industry leader starts here. Reach out today and explore how we can help you achieve your entrepreneurial goals with ease!

1. What is a franchise agreement?

A franchise agreement is a contract that outlines the terms, fees, and responsibilities between the franchisor and the franchisee.

2. Do I need an FSSAI license for a food franchise in India?

Yes, an FSSAI license is mandatory for food-related franchises in India to ensure compliance with food safety regulations.

3. Is FDI allowed in franchising in India?

Yes, FDI is allowed. Foreign companies can own 100% in single-brand retail and up to 51% in multi-brand retail.

4. What intellectual property (IP) protections do I need for my franchise?

Register trademarks, logos, and business systems to protect your intellectual property.

5. How can I resolve disputes with my franchisee?

Disputes can be resolved through arbitration or mediation, as outlined in the franchise agreement.